- Daily Alpha - VEMP

- Posts

- 🚀 Crypto is not the biggest risk in investment for next year, according to a FED report

🚀 Crypto is not the biggest risk in investment for next year, according to a FED report

🚀 Crypto is not the biggest risk in investment for next year, according to a FED report 🥴 There might be transaction and store-of-value limits for the proposed Digital Euro project 🚗 The Ethereum Roadmap: The Scourge and the integration of SNARKs

GM. If you still hide that silly inflationary fiat under your mattress, you're missing out.

We're here to remind you that $VEMP still can be bought with fiat using the TradeStrike app. Use Apple Pay and grab some $VEMP in seconds! You still get a 100% buy boost when you use Apple Pay.

Get $VEMP, stake it, and earn some yield! DeFi is the future 🚀

🚀 Crypto is not the biggest risk in investment for next year, according to a FED report

🥴 There might be transaction and store-of-value limits for the proposed Digital Euro project

🚗 The Ethereum Roadmap: The Scourge and the integration of SNARKs

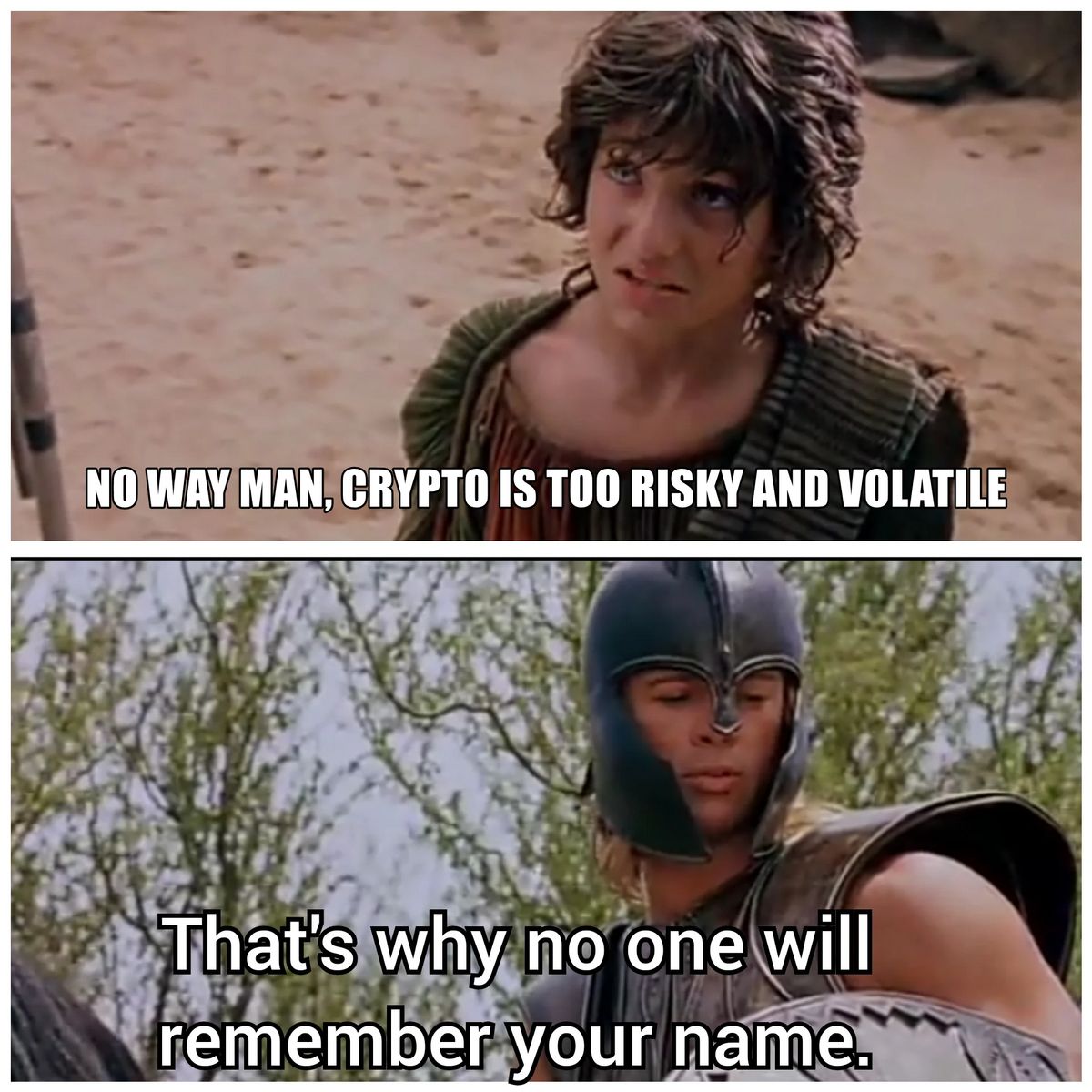

Crypto is not the biggest risk in investment for next year, according to a FED report

According to a survey conducted by the Federal Reserve Bank of New York, there are 11 factors that overshadow crypto in terms of risk in 2022. These include geopolitical tensions, foreign divestments, COVID-19 and high energy prices.

Topping the list of risks is the power struggle between the U.S and China, which has led to a lot of uncertainty in the global economy. This is followed by the conflict in Ukraine and the Russian sanctions, which have caused a rise in energy prices.

Inflation is another major concern, as it erodes the purchasing power of investors and savers. The COVID-19 pandemic has also had a significant impact on the economy, leading to job losses and businesses shutting down.

Cyberattacks were also highlighted as a major risk worse than crypto, as they can lead to the theft of personal, financial, and corporate data, as well as disrupt critical infrastructure.

Crypto ranks at 12th place on this list of risks, and this shift in mentality among investors shows that crypto entrepreneurs are working to spread awareness about this new asset class - despite the US government's negative opinion of crypto.

In the end, this is still good news for the crypto community, as it shows that we are slowly but surely gaining mainstream adoption. So, even though there are risks involved in investing in crypto, the potential rewards still outweigh the risks. So, don’t let the naysayers get you down and continue HODLing!

There might be transaction and store-of-value limits for the proposed Digital Euro project

EU'S CBDC (Central Bank Digital Currency) aka "the Digital Euro" may have transaction and store-of-value limits. That's according to European Central Bank's executive board member Fabio Panetta, who said this at the "Towards a legislative framework enabling a digital euro" conference.

He said that this was necessary to prevent any threat to financial stability in times of crisis. The ECB is currently looking into introducing transaction limits for the potential CBDC.

“There will be risks that people could use this possibility to move, for example, their deposits of other banks or their money out of financial intermediates.” Panetta said.

Indeed, being able to do anything you want with your own money is one of the main reasons why people use cryptocurrencies. So, if the ECB does implement these kinds of limits, it's likely that many people will simply look for alternatives.

Panetta also pointed toward a €50 cap on transactions, citing anti-money laundering provisions, to which Christian Lindner, the German minister of finance, expressed concerns. “I wonder whether people would accept €50 as they can pay in cash hundreds and more,” he said, adding: “We should introduce a digital euro that is really accepted by people and not only by policymakers.”

Oh well. While big wigs are struggling to invent the wheel all over again, the crypto world is way ahead, with BTC, ETH, and thousands of others already being used as a store of value and means of payment on a global scale. So, it looks like we'll just have to wait and see what happens with the digital euro, which is expected to be decided on by September 2023. In the meantime, we can all continue using crypto however we please, and hopefully, it stays that way.

The Ethereum Roadmap: the Scourge and the integration of SNARKs

Vitalik has updated Ethereum's roadmap with a new stage: the Scourge. Ethereum's roadmap already consisted of five phases, "The Merge" (which had recently happened), "The Surge", "The Verge", "The Purge" and "The Splurge".

But with the recent introduction of the Scourge, there are now six phases in total. So what is the Scourge? Vitalik describes it as a "credibly neutral transaction inclusion mechanism", which will "avoid centralization and other protocol risks from MEV". In other words, it's a way to make sure that miners can't exploit transactions for their own benefit. This is good, because it will make Ethereum more reliable and trustworthy.

But why is it called the Scourge? We're not sure, we think Vitalik was just running out of rhyming names. But most importantly, it's another step towards making Ethereum the most secure and reliable platform it can be.

Vitalik also confirmed an upcoming update to the Verge – which will now involve the integration of SNARKs onto Ethereum. The addition of SNARKs will add privacy-preserving features to the Ethereum network while still allowing for anonymous transactions to be traceable.

This is all part of Ethereum's plan to become the world's most-used blockchain, and if devs keep up the good work, they just might succeed.