- Daily Alpha - VEMP

- Posts

- 🤒 CZ speaks out on the future of stablecoins

🤒 CZ speaks out on the future of stablecoins

🤒 CZ speaks out on the future of stablecoins 🤪 Blur airdrop mania 💸 Former FTX chief of staff made millions on a charity scheme

GM, vEmpions.

We've recently completed another successful Buy-Back & Burn! 🔥 This time, 220k $VEMP has been bought and sent to a dead wallet. 🤝

If you're interested in finding out more, head over to our new staking platform and track the live burn supply. 👀 You can view all of the burn transactions and analyze the data to gain insights into our progress"

🤒 CZ speaks out on the future of stablecoins

🤪 Blur airdrop mania

💸 Former FTX chief of staff made millions on a charity scheme

CZ speaks out on the future of stablecoins

CZ has recently made a statement during an AMA that in the future, instead of relying on US dollar-based stablecoins, crypto industry will probably start using Euro, Yen, or Singapore dollar based stablecoins.

While this does make sense, according to CZ, it seems that the crypto industry still has one foot firmly planted in the past when it comes to money. After all, when do most people calculate their investment returns? Obviously, US dollars.

CZ has also mentioned the potential role of algorithmic stablecoins in the future of crypto and the risks associated with their use. He believes that these risks need to be made transparently available to users, so they can make informed decisions when choosing a stablecoin.

What's going to happen next? Will the crypto industry move away from US dollars and embrace a new era of algorithmic stablecoins or Euro/Yen? No one can tell for sure, but it's clear that CZ is laying the groundwork for what's to come. Hopefully, the crypto industry will be able to safely and securely transition into this new phase.

Blur airdrop mania

BLUR's airdrop the other day turned out to be a complete spectacle as grifters and freeloaders of all kinds have gathered for their chance to get rich quick.

Blur launched last year and through these kinds of events has managed to surpass OpenSea by trading volume, although long term it might be a different story.

This is the second time Blur is airdropping tokens, the first time the traders had to list an NFT in order to claim rewards. This time around it went pretty much the same way, although the difference is that the users exploited this formula to the fullest, racing to list, buy and stake as many NFTs as possible. Of course, some used scripts, bots and additional programs to max out on their rewards.

The result? The top *claimant* managed to walk away with over $1.9 million worth of BLUR tokens, leaving everyone else scratching their heads and wondering what just happened.

It's unclear who this top claimant is, but based on their activity it looks like they're a high roller in the NFT space, trading Other Side and Mutant Ape Yacht Club NFTs for some serious amounts of money. A look at the trading activity from the wallet shows that the holder has been buying and selling loads of the same NFTs over and over again, suggesting an effort to manipulate the Blur reward model.

People dumped QUICK.

Like, almost 90% down in minutes quick.

— HashBastards NFTs 🤑 (@HashBastardsNFT)

7:13 PM • Feb 14, 2023

The token price of course crashed shortly after the airdrop, down 88% from its peak at one point. This is a pretty clear indication that the event was driven by speculators and only time will tell if this airdrop was just another blip in the crypto space or something more enduring.

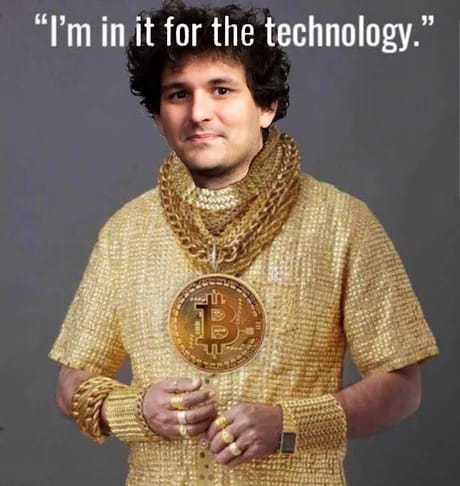

Former FTX chief of staff made millions on a charity scheme

FTX is popping up in the news again as Wall Street Journal revealed that Ruairi Donnelly, the former chief of staff at FTX and Alameda Research, made a killing off an insider deal.

According to reports, Polaris Ventures, a charity created by Donnelly, is trying to access an estimated $150 million earned from selling tokens that Donnelly received at a rate of $0.05 per token, which he then sold for a whopping $1 each.

His legal team already said the tokens were not FTX’s funds and seemingly not subject to claims from other parties. However, regulators have announced investigations into Effective Ventures - the charity part-funded by FTX - nonetheless.

FTX was surely a golden goose for those involved with it, but hopefully what happened in this case won’t become the norm.